Credit Resources

Credit is a powerful financial tool for acquiring a home, car, or major purchase

Understanding your credit scores is important. Use our Credit Resources page to learn more about how to improve, maintain and monitor your credit scores.

Understanding Your Credit Scores

Yes, we said scores. This is because your credit rating is comprised of different scores based on different scoring models, and multiple credit reporting agencies. On top of this, there are also scores for different product types such as auto and home insurance.

The two main credit scoring models are Vantage and FICO. There are also multiple, less used, alternative models such as TransRisk, CE Credit Score, and Experian’s National Equivalency Score. Each model uses its own unique scoring methodology and bases its scores on different factors. Not very many lending institutions have adopted an alternative model. This is mostly due to their scores typically varying quite a bit from the more trusted FICO or Vantage scores.

There are three credit reporting agencies: Experian, Equifax, and TransUnion. Your score with each can vary slightly but are usually close to one another. The reason they are not the same is they may use a slightly different scoring method, and not all vendors report to all three agencies. For instance, there may be data on your TransUnion report that is not on your Equifax report.

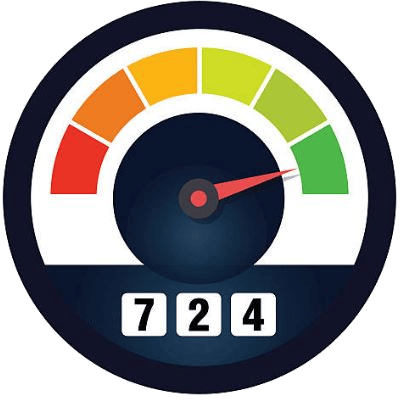

If your main objective is to buy a home, a car, or some other major purchase, you will want to strive hard to maintain a good credit score. Generally, a score of 690 to 719 is considered good, and a score of 720 or higher is considered excellent. See our charts below for more scoring details.

VantageScore 3.0® Ranges

Rating

300-600

Poor

601-660

Fair

661-780

Good

781-850

Excellent

How VantageScore 3.0 is Calculated

Since the credit company’s method for calculating credit is proprietary, there is no way to know the exact formula of their credit scoring. With that said, VantageScore does give some detail as to what factors they weigh the most in calculating credit score.

- Credit usage – In a nutshell this is what percentage of your available credit you use on average. (Somewhat weighed)

- Credit history age – How far back your credit history goes. (Not much weight)

- New credit accounts – How often you apply for or open new credit accounts. (Not much weight)

- Payment history – How often you pay your bills on time or early. (Weighed heavily)

- Credit mixture – This is the different types of credit lines or loans you have had, (Weighed moderately heavy)

Some things that VantageScore has on their list do not carry any weight in your credit rating such as your income, where you live, and other demographics.

FICO® 8 and 9 Ranges

Rating

300-579

Poor

580-669

Fair

670-739

Good

740-799

Very Good

800-855

Exceptional

FICO® Industry Specific Ranges

Rating

250-579

Poor

580-669

Fair

670-739

Good

740-799

Very Good

800-855

Exceptional

Here’s a breakdown of the five elements of the FICO score:

A credit score is determined much like a grade in school. Consider how a teacher calculates grades by taking scores from tests, homework, attendance and anything else they want to use, weighing each one according to importance to come up with a final, single-number score. It’s the same for a credit score. But instead of using the scores from pop quizzes and papers, it uses the information in your credit report. The number ranges from 300 to 850. Although the exact formula for calculating the score is proprietary information and owned by Fair Isaac, here’s an approximate breakdown of how it is determined:

Payment history: 35%

The moral of this story is to pay your bills on time. If you can’t pay on time for some reason, contact the lender to let them know why. Lenders are a very cautious group by nature and necessity, and they really like predictability. Therefore, the biggest factor is which open credit accounts you have, if you pay them on time, and — if you’re late — how late the payments were.

Amounts of money owed: 30%

Lenders and credit bureaus look at the amount of debt you owe relative to the amount of available credit — your debt-to-credit ratio. You want that ratio to be as low as possible to benefit your credit score.

Length of credit history: 15%

The date that you open a line of credit has some relevance in calculating your credit score. A lender will be able to see how long you’ve been using credit lines, when you opened an account, what type of account you opened, and how long it’s been since you had any activity on the accounts.

New lines of credit: 10%

This factor entails the number of accounts you’ve opened recently, the type of accounts, the number of recent credit inquiries (by whom and when), and when you opened the accounts. In order to keep your credit score from decreasing, try not to open several new lines of credit in a brief period. Lenders and credit bureaus can view that as a desperate need for money.

Types of credit used: 10%

For this percentage, credit bureaus look at how many different types of credit you currently use and have used in the past, such as credit cards, mortgage, car loan, retail accounts, etc.

Each of the major credit reporting bureaus (TransUnion, Equifax and Experian) use formulas like this to calculate your credit score, with slight differences in their exact formulas. Now that you know how your credit score is calculated, you can gain a better understanding of the importance of each of these factors and be on your way to a better credit score.

Helpful Links for Checking and Monitoring Your Credit

Experian

Your credit report, FICO Score,

and more. All free.

Equifax

Equifax can help monitor your credit reports and better protect yourself from identity theft.

TransUnion

Make sure your credit stays right-side-up with TransUnion

AnnualCreditReport.com

The only source for your free credit reports. Authorized by Federal law.

Tips to Improve Your Credit Score

We will list our credit improving tips in order from most helpful to least helpful. But like most tips on any given topic, it’s a good idea to focus your efforts on all of them. Tip number 3 could be the 5-point difference needed between getting to an excellent credit score from a very good one. Unfortunately, to the creditor or lender on the other side of an online application, you are that credit score. That may seem a bit impersonal, but the truth is you are a credit score number to lenders.

There is good news for those with a low to very low score and that is that you can improve it. It won’t happen overnight, but there are proactive steps you can take to greatly speed it up. So, without any further ado, let’s get into the credit improving tips.

- Tip #1 – Pay your bills by, or before, their due date. This may seem too obvious, but not paying bills on time can very negatively pull down your credit score. This is especially true if you habitually pay your bills late. In fact, payment history accounts for 35 percent of your credit score. One way to help avoid paying late is to set any payments you can on auto payment. Any that you can’t set up on auto pay, make a reminder that alerts you with enough time to get your payment made before it’s due.

- Tip #2 – Pay down your credit card balance below 25 percent and then keep them below 25 percent. The amount of credit you hold and maintain on average accounts for 30 percent of your overall score. If you need more credit limit to keep your average usage below 25 percent, you can keep old cards open and you can request a credit limit from your existing credit card companies.

- Tip #3 – Check for mistakes on your credit report. If you do see what you think is a mistake, ask to have it reviewed and removed. This tip is a wildcard because it may or may not apply to you. If it does apply to you, though, it can drastically improve your credit score in a short amount of time.

If you do believe there is a mistake, or mistakes, on your credit report, you can use our cease-and-desist letter, 609 letter, 611 letter, or 623 letter to make your investigation and removal request. You will see a description as to which one applies to you.

Benefits of Maintaining a High Credit Score

Maintaining a high credit score doesn’t only dictate what you can purchase, it is also the main determining factor as to how generous of an interest rate and term you will get. When you have a high credit score you can not only buy a car from any major car dealer, but you will also get a favorable interest rate. Without a very good to excellent credit score, you may find yourself having to purchase a car from a buy here, pay here dealer with a very high interest rate.

The main takeaways here are to maintain a 25 percent or lower debt cap, pay your bills on time, and check your credit periodically to make certain there isn’t any incorrect negative data on your reports.