Payday Loans

Get a Free Savings Quote* & Consultation

Do you find yourself applying for a payday loan just to cover the fees of your previous payday loan? Through our Payday Loan Debt Consolidation program, we may be able to help.

Payday Loans

Payday Loans

Are you plagued with increasing payday loan debt? Never-ending torment from irritating collection calls at all hours of the day? Are you tired of ridiculously high monthly payments? Do you find yourself applying for a payday loan just to cover the fees of your previous payday loan? Through our Payday Loan Debt Consolidation program, we may be able to help. Our goal is to help our customers consolidate their payday loan debt in the shortest time period possible. We aim to settle our customers’ debt by negotiating the lowest cost and strive to provide manageable payments they are sure to afford. Our program can bring current minimum payments down, allowing our customers to get out of debt anywhere from 6, 12, or 18 months. Call us today to learn how we can help!

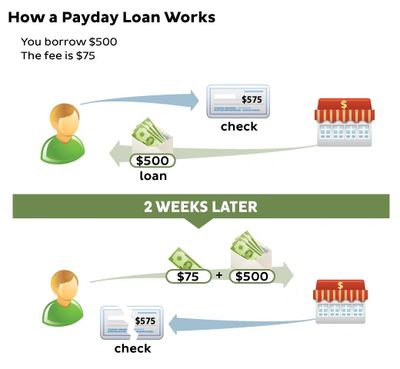

- What is a payday loan or cash advance loan? A payday loan or a cash advance loan is a loan for a short time. You pay a fee to borrow the money, even if it is for a week or two.

- How does a payday loan or cash advance loan work? You give the lender a check for the amount of money you want to borrow – plus a fee. The lender keeps your check and gives you cash – less the fee they charge. On your next payday, you must pay the lender in cash. You owe the amount you borrowed plus the fee.

Example of Payday Loan Fees

- You borrow $500. The fee is $75.

- You give the lender a check for $575.

- The lender keeps your check and gives you $500 in cash.

- After two weeks, you give the lender $575 cash, and you get your check back.

- The bottom line: You paid $75 to borrow $500 for two weeks.

What happens if I can’t pay the lender the money I owe?

If you cannot pay the lender the money you owe, you borrow the money for two more weeks. This is called a “rollover,” or “rolling over” the loan. To rollover the loan, you pay another fee. These high fees add up quickly and make it extremely hard to pay off the principal balance.